Corruption in your Face – India suffers from blatant breaking of rules in corporate cronyism

January 21, 2015India’s National Electric Mobility Mission Plan (NEMMP) seems unrealistic with 6-7 million target by 2020

January 23, 2015Dice Holdings Inc

Dice Holdings Inc. (DHX) host websites customized to meet the requirements of select professional communities. The websites are customized for specific professions and hence make recruiting process more organized and efficient. At present the company focuses on six such specialized fields – technology and security clearance, financial services, energy, healthcare, hospitality and corporate industry. The company has also acquired many focused websites to expand its portfolio in different fields. DICE has a user friendly interface and has apps for Apple and Android products. The company has presence in the American, European, Asian and Australian markets. The company earns revenue through various recruitment packages like job posting and access to the database of candidates, website advertising and marketing solutions.

Given its good quarterly performance, robust outlook, geographic diversification and focus on the job market I would look at buying the stock.

Background

Dice is an acronym for “Data-processing Independent Consultant’s Exchange”. Dice Holdings Inc. is the holding company, owning all these careers websites specializing in fields like technology, finance, hospitality, healthcare and energy. The company works in online employment and advertising segment catering to the staffing and employment industry. Dice originally started as a bulletin board service for job listings by recruiters. Later on in 1999, it opened a career website serving the direct hiring companies, while continuing to cater to the needs of the recruiting and staffing industry. Dice was acquired by EarthWeb, which later on changed its name to Dice Inc in 2001. After a couple of years, Dice Inc. went private and was acquired by Dice Holdings, Inc. In 2007, the company finished its IPO and started trading on NYSE under the ticker symbol DHX.

What I like about Dice

1) Good Q3 Performance – The company reported good Q3 2014 results with growth in both billings and sales. Total revenues amounted to $67.6 million, which was a 29% increase on a year-on-year basis. Billings increased by 37%, 18%, 7% for Energy, Finance, Tech & Clearance respectively. The company posted net income in Q3 of $9.5 million, resulting in diluted earnings per share of $0.18.

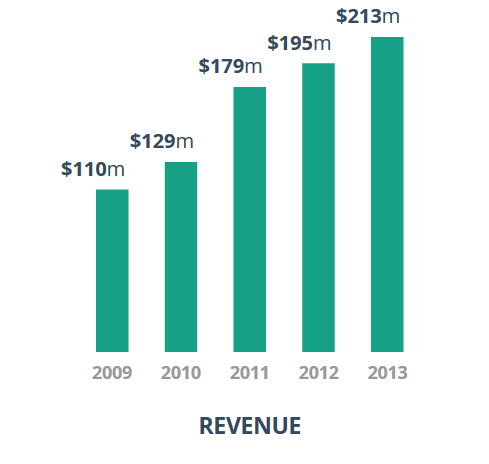

2) DICE has more than doubled its revenue in the last 5 years

Source: DICE

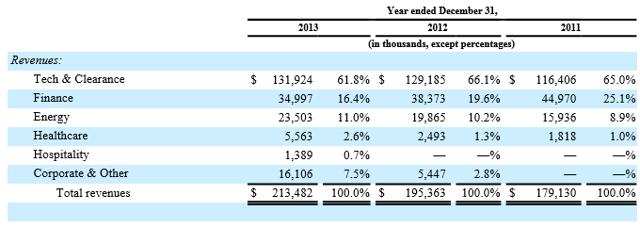

3) Products & Services – Dice Holdings has six specific areas of specialization as mentioned above, with Tech & Clearance constituting ~60% of total revenues, followed by Finance (~16%) and Energy (~11%). The company hosts a number of websites like Dice.com, eFinancialCareers, Slashdot, IT Job Board etc. Dice.com is the leading recruiting and career development website for professionals in technology and engineering field in the US. These websites not only provide specific type of jobs, but also give an option to browse jobs based on one’s skill, title and location. For example, the IT Job Board gives an option to choose between UNIX, JAVA, Oracle, CISCO jobs. In addition to the above the company provides services like The Dice Report and Open Web.

| Segment | Leading Websites | |

| 1 | Tech & Clearance | Dice.com, ClearanceJobs.com and IT Job Board |

| 2 | Finance | eFinancialCareers |

| 3 | Energy | Rigzone |

| 4 | Healthcare | HEALTHeCAREERS, BioSpace |

| 5 | Hospitality | Hcareers |

| 6 | Corporate & Other | Slashdot Media, WorkDigital |

Revenue Segment & Breakup of Revenue

4) One of its kind – Though Dice is competing with the industry giants like LinkedIn (LNKD) and Monster (MWW), it still has its own importance. Skill specific websites allow both the recruiter and job seeker to cut through the clutter and leads to better search. I think these kind of websites will be more dominant in the future. The finance vertical has a number of sub-categories, while the technology vertical has even more sub-categories. Hence with the advent of Dice, a job seeker will know which website he wants to share his resume, rather than posting it on a general recruitment website. Similarly it will be easier for an employer to find the candidate with skills and expertise in a particular field.

5) Strategic Acquisitions – Dice has been engaged in acquiring recruiting websites which focus on different fields. The company has made 11 acquisitions since 2004. It recently acquired OilCareers in March 2014. In November 2013, Dice acquired onTargetjobs including HEALTHeCAREERS, Hcareers and Biospace.

6) New Products – Open Web product launched by the company in December 2014, is a favorite amongst the recruiters. It collates a candidate’s data from 130 social and professional websites and presents it in a simple format. It is gaining popularity amongst the recruiting industry, who do not need to visit different websites now to learn about a candidate’s social presence and his interests. Open Web is currently available for the finance vertical through eFinancialCareers and has reached 600 customers this quarter.

7) Stock Repurchase – During Q3 2014, Dice repurchased 1.1 million shares of common shares at an average cost of $8.22 per share for approximately $8.7 million. The Board of Directors has additionally authorized a $50 million stock repurchase program. The company is engaged in stock repurchase programs since 2011 and has returned more than $175 million to shareholders.

8) Strong growth in Asia – Asia continues to be a strong market in Finance segment for Dice, with 14% increase in revenues; while Australia had soft demand. The company is also gaining traction in Hong Kong and Singapore, Germany, France and Switzerland.

9) Diversified Customer Base – Dice has a customer base of over 15000, including small, mid-sized and large direct employers, staffing companies, recruiting agencies, consulting firms and corporates. Some of the notable customers include AT&T (T), Adecco, Amazon (AMZN), Facebook (FB), Manpower, Microsoft (MSFT), etc.

Outlook

The company increased its outlook for the full year 2014. Full year revenues will be in the range of $262.5-263 million with EPS anticipated to be in $0.50-0.51 for 2014.

Dice Risks

Competition – Dice suffers strong competition from the social and professional networking sites, such as LinkedIn and Facebook ; job boards like CareerBuilder and Monster and other classified advertising media like Talent Bin, Google and Craigslist etc.

Given below is the five year stock analysis for Dice which returned close to 63%, outperforming Monster Worldwide with -72% returns. Both Dice & Monster have comparable market capitalisation value. However, it underperformed others like LinkedIn and 51job Inc (JOBS). LinkedIn is another professional networking website, providing services in more than 20 languages and earning its revenue through fees and various advertising programs on its website. It is popular globally and is also trying to increase its foothold in the developing economies in the EMEA and APAC regions. 51job Inc is popular in China and earns revenues in the form of fees from employers for placing job advertisements.

Stock Performance & Valuation

The stock is currently trading at ~$10 with a market capitalization of ~$535 million. The stock trades at a P/B of 3.1x, which is cheaper than industry average of 3.8x. The stock gave better returns (~37.32%) than the broader S&P market (~10.33%) in the last one year.

Conclusion

Dice Holdings Inc. is taking a different approach to the recruitment industry. It is reorganizing the process, making it more convenient both for the employer and job seeker to find each other. The company gave good quarterly results and a robust outlook. With various categorization and new sub divisions emerging in particular kind of jobs, I think Dice will definitely gain more traction especially in the developing economies. The prospects of the company is bright since the global market for online staffing and employment advertising is growing at a fast pace. The company is expanding its geographical presence. With the job market set to improve in 2015, the company should continue to show good growth. I would thus look to adding the stock at dips.